SAN FRANCISCO — An expensive mistake by Google could turn into a golden opportunity for China’s Lenovo Group as it expands beyond its success in the personal computer industry.

Google is ridding itself of a financial headache by selling Motorola Mobility’s smartphone business to Lenovo for $2.9 billion. The deal announced late Wednesday comes less than two years after Google bought Motorola Mobility for $12.4 billion in the biggest acquisition of Google’s 15-year history.

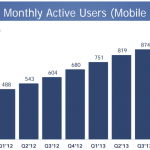

While Google Inc. is backpedaling, Lenovo Group Ltd. is gearing up for a major expansion. Already the world’s largest PC maker, Lenovo is now determined to become a bigger player in smartphones as more people rely on them instead of laptop and desktop computers to go online.

Lenovo already is among the smartphone leaders in its home country, but it has been looking for ways to expand its presence in other markets, especially the U.S. and Latin America. The company had been rumored to be among the prospective buyers for BlackBerry Ltd. when that troubled smartphone maker was mulling a sale last year.

“We will be going from an emerging-market player to a worldwide player in smartphones,” Lenovo CEO Yang Yuanqing said in an interview with The Associated Press.

This marks Lenovo’s second high-profile deal this month. The company announced plans last week to buy a major piece of IBM Corp.’s computer server business for $2.3 billion.

For Google, the sale is a tacit admission that a company that prides itself on employing some of the world’s smartest people miscalculated how much Motorola was worth.

Google previously recovered some of the money that it spent on Motorola by selling its set-top operations last year to Arris Group Inc. for $2.35 billion.

And Google is holding on to most of Motorola’s more than 20,000 mobile patents, providing Google with legal protection for its widely used Android software for smartphones and tablet computers. Gaining control of Motorola’s patents was the main reason Google was willing to pay so much for a smartphone maker that was already losing money and market share.

The Motorola patents were valued at $5.5 billion at the time Google took over, according to regulatory filings.

Factoring all that, there’s a gap of roughly $1.65 billion between what Google paid for Motorola and what Google is getting from its sales to Arris and Lenovo, plus the original value of the patents. What’s not known is the value of the patents Google is keeping, as Lenovo is picking up about 2,000 Motorola patents in addition to the phone manufacturing operations.

It’s also unclear if Google will have to absorb a charge to account for its apparent miscalculation of Motorola Mobility’s value. The Mountain View, Calif., company may address the issue Thursday when it announces its fourth-quarter earnings after the market closes.

Most investors viewed Motorola as an unnecessary drain on Google’s profit, a perspective that was reflected by Wall Street’s reaction to the sale. Google’s stock gained $28.08, or 2.5 percent, to $1,135 in extended trading.

A cellphone pioneer, Motorola Mobility had its last big hit with the Razr flip phone, which came out in 2004. Its product line became outmoded after Apple Inc. released the iPhone in 2007, unleashing a new era of touch-screen phones. Motorola hasn’t been able to catch up yet, even as last summer’s Moto X received positive reviews.

Motorola’s losses are likely to dampen Google’s earnings at least for the first half of this year. That’s because it’s expected to take six to nine months before the proposed sale gets the necessary approvals from regulators.

Buying Motorola will enable Lenovo to join Apple Inc. as the only major technology companies with global product lines in PCs, smartphones and tablets, putting Lenovo in a better position to become a one-stop shop for companies to buy all their devices from the same vendor, said Forrester Research analyst Frank Gillett.

“This makes Lenovo a company to watch,” Gillett said in an email. “The personal device manufacturer business is consolidating — and manufacturers must compete in all three device markets, plus emerging wearable categories, or get left out of the next market shift.”

Lenovo plans to keep both smartphone brands, selling under Motorola’s name in developed markets and under its own in developing countries where it already is established, chief financial officer Wong Waiming told reporters.

Lenovo’s annual smartphone revenues are about $4 billion and, with the addition of Motorola, the company hopes to increase that quickly to $10 billion, Wong said in a conference call.

The Chinese company is paying a portion of the purchase price to Google with $750 million in Lenovo shares. Wong said that was part of a “strategic relationship the two groups want to establish.” He said details still are being discussed.

___

AP business writers Ryan Nakashima in Los Angeles and Joe McDonald in Beijing contributed to this story.