Republican presidential candidate Mitt Romney and his wife Ann paid $3 million in federal taxes in 2010 on nearly $21.7 million of income derived from a vast array of investments, amounting to an effective tax rate of 13.9%, according returns released by his campaign Tuesday.

In addition, the Romneys expect to pay $3.2 million on $20.9 million of income for the 2011 tax year, for an effective rate of 15.4%.

That’s substantially lower than the top 35% marginal tax rate on wages and salaries — and much lower than the rate than his political rivals. President Obama paid an effective tax rate of 26% in 2010, while former House Speaker Newt Gingrich paid a rate of 31.6%. Experts say Romney benefits from a tax code that allows investors to keep more of their income than wage earners, particularly investors in the rarefied world of private equity.

Even among his wealthy peers — a cohort that particularly benefits from the lower capital gains rate — Romney’s rate is below the average 18.5% effective tax rate paid by the richest 1%, according to the Tax Policy Center.

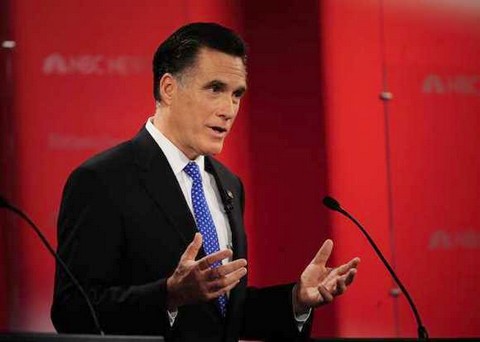

“I pay all the taxes that are legally required and not a dollar more,” Romney said in a debate in Tampa Monday night hosted by NBC. “ I don’t think you want someone as the candidate for president who pays more taxes than he owes.”

“I’m proud of the fact that I pay a lot of taxes, and the fact is there are a lot of people in this country that pay a lot of taxes,” he added. “I’d like to see our tax rate come down and focus on growing the country, getting people back to work. That’s our problem in this country right now.”

On Tuesday, the Romney campaign released a statement from former IRS commissioner Fred Goldberg saying he had vetted the tax returns.

“These returns reflect the complexity of our tax laws and the types of investment activity that I would anticipate for persons in their circumstances,” Goldberg said. “There is no indication or suggestion of any tax-motivated or aggressive tax planning activities. In my judgment, they have fully satisfied their responsibilities as taxpayers. They have done so by relying on a highly reputable return preparer and other advisors, who have in turn relied primarily on information provided by third parties to them and to the IRS. The end result of that process has been returns that include a multitude of schedules, IRS forms and accompanying statements that provide appropriate transparency and the proper payment of taxes that Governor and Mrs. Romney owe under current law.”

The longtime private-equity chieftain hopeful released his tax returns after pressure from Gingrich and at the urging of his political allies, who fretted that the matter was becoming a dangerous distraction.

The former Massachusetts governor has revealed in financial disclosure forms in the past that he is worth as much as $250 million, but he had never released tax returns that reveal how much money he makes each year – or how much he pays in taxes.

The release of Romney’s federal tax returns may not provide dramatic new insight into his finances, but it is sure to fuel the increasingly high-decibel debate about economic disparity and tax fairness that has overtaken this year’s presidential contest and repeatedly tripped up the Republican presidential hopeful.

Speaking on NBC’s “Today” show Tuesday, senior White House advisor David Plouffe called Romney’s taxes “a good example…of the tax reform we need.”

“There’s no question that we have a tax code that’s far too complicated, far too complex, and when the average middle class worker is paying more in taxes than people who are making $50, 60 million a year, we’ve got to change that,” he said.

The intense focus on Romney’s tax returns underscores how the very core of his candidacy – his experience leading a private equity firm – is also proving to be a liability in a political climate in which class issues have taken center stage.

Gingrich has been hammering Romney over his tenure at Bain Capital, while Democrats have taken to gleefully mocking the him as a modern-day Gordon Gekko, the high-flying financier portrayed in the movie “Wall Street.”

“For the average person, it raises the issue of why some of the wealthiest people in the world are taxed at some of the lowest rates we have,” said Joseph Bankman, a professor of tax law at Stanford Law School. “Here is someone who kind of personifies income inequality.”

Romney’s returns show how much he has gained from paying the lower capital gains rate on much of his income from Bain, the private equity firm he co-founded in the mid-1980s.

The Romney returns also spotlight the other, congressionally mandated tax advantages enjoyed by the rich to reduce their tax burdens, as well as how much of his wealth is tied up in funds based in low-tax jurisdictions overseas, including the Cayman Islands.

Romney spokeswoman Andrea Saul said Monday that Romney’s overseas investments are not tax havens. “The Romneys’ investments in funds established in the Cayman Islands are taxed in the very same way they would be if those funds were established in the United States,” she said.

A public perception that the wealthy don’t pay their fair share of taxes has risen in recent years. A Pew Research Center study last month found that 73% of Democrats and 57% of independents cited it as their top complaint about the federal tax system, along with 38% of Republicans.