(Reuters) – Top hedge funds shed their stakes in high-profile Internet names such as Netflix Inc and Groupon Inc in the first quarter, moving to peers viewed as more mature and less volatile.

High-growth Internet software and biotech companies were the darlings of 2013, but their shares started to fall sharply in early March. Netflix, last year’s biggest S&P 500 gainer and an important hedge fund holding, is down more than 24 percent from its closing high this year.

Hedge funds invested in technology and healthcare fell 3.65 percent in April, the biggest monthly decline since October 2008 and extending March’s 1.8 percent decline, according to data from Hedge Fund Research.

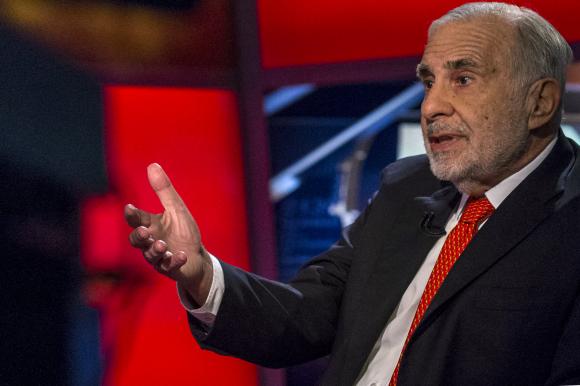

Among prominent hedge fund managers, Carl Icahn cut his holding in Netflix by 15.8 percent in the first quarter, reducing it to about 2.2 million shares. Tiger Global Management sold its entire stake of 663,000 shares during the quarter.

Netflix was up on the year for most of the first quarter, so the fund is likely to have sold at the right time.

Tiger also dumped its stake of 11.46 million shares in Groupon. That position was worth $134.9 million at the end of 2013 and $89.9 million at the end of the quarter.

The Internet software and services sector now accounts for about 10 percent of the top 100 long positions for equity/long short hedge funds, down from 20 percent to 25 percent in January, according to Credit Suisse data.

Long/short hedge fund managers moved to short bets in Internet names amid a meltdown in the group, according to Credit Suisse. Long positions in the group now account for about 25 percent of the overall gross exposure to the group, which adds together both long and short positions. That’s the lowest rate in at least three years.

Some funds added to their momentum exposure, with Jana Partners increasing its stake in Groupon by almost 32 percent to 40.8 million shares.

Other funds moved to technology names with less lofty valuations and that are viewed as more established. Third Point sold its stakes in both Yahoo Inc and biotech company Gilead Sciences Inc but increased its Google Inc holdings by 31.3 percent.

EBay Inc, which became a darling among top U.S. hedge funds in the fourth quarter just before billionaire activist investor Carl Icahn urged the company to spin off its PayPal business, continued to find fans in the first quarter.

Omega more than tripled its stake in eBay, bringing it to 2.9 million shares, while Jana opened a stake of 3.9 million shares in the first quarter. Icahn, who backed down from his demands, disclosed a new stake in eBay, holding 27.8 million shares as of March 31.

(Reporting by Ryan Vlastelica; Additional reporting by David Gaffen and Sam Forgione; Editing by Steve Orlofsky)